# 🟢 TL;DR – Quick Summary

Intel just dropped its Q2 2025 earnings, and the stock is buzzing. Revenue was better than expected, but guidance disappointed. Is it still a buy? Let’s break it down.

{.aligncenter}

💰 **What Did Intel Report in Q2 2025?**

Intel (ticker: INTC) released its Q2 earnings on July 25. Here’s the snapshot:

Revenue: $13.3 billion (beat expectations by $100M)

Earnings per share (EPS): $0.45

Gross margin: 42.4%

Q3 revenue guidance: $12.9–13.9 billion (weaker than Wall Street hoped)

Despite solid numbers this quarter, investors are cautious about slowing momentum in the second half of 2025.

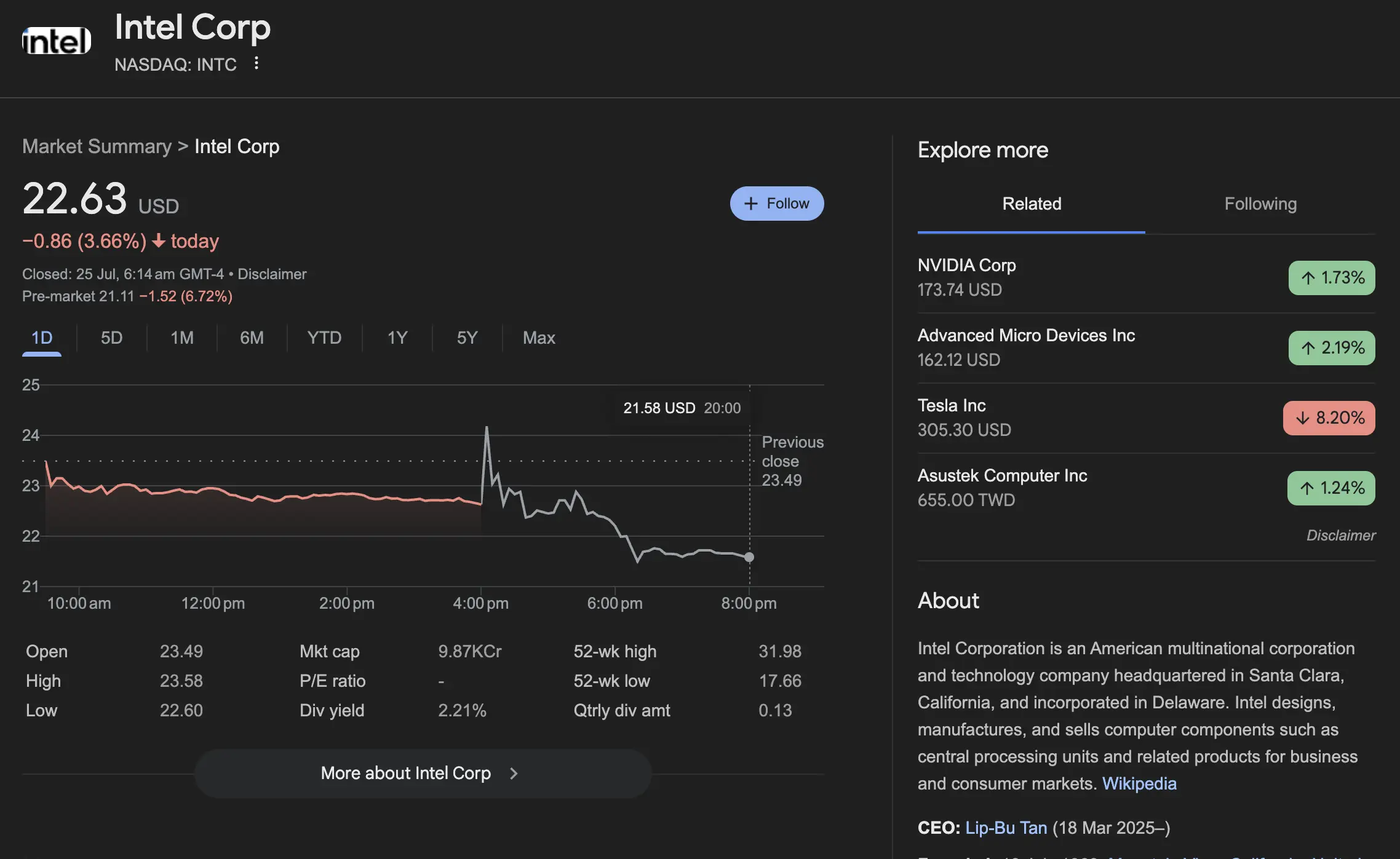

📉 **Why Did Intel Stock Dip After Earnings?**

Even though Intel beat expectations, the stock dropped around 6% after hours. Why?

Weak Q3 outlook: Wall Street wanted stronger guidance.

Foundry struggles: Intel Foundry Services posted a $113M loss.

Competition from Nvidia and AMD: They’re gaining ground in AI chips.

📌 **Quick Answer: **Intel stock dipped not because Q2 was bad, but because the future looks uncertain — especially in AI.

– {.aligncenter}

🤔 **Is Intel Stock Still Worth Buying?**

That depends on your investment strategy. Here’s a breakdown:

✅ **Good reasons to consider buying:**

Still trading at a reasonable P/E ratio

Long-term bet on U.S. semiconductor independence

Solid dividend (1.5%+ yield)

🚩 **But also, watch out for:**

Delay in foundry profits

Nvidia is way ahead in AI chips

Weak guidance shakes confidence

🧠 If you’re long-term and believe in Intel’s manufacturing comeback — this could be a buy-the-dip moment.

📊 **How Is the Market Reacting?**

INTC stock closed at $34.15, then dropped to $32.10 in after-hours trading.

Volume surged post-earnings — over 60 million shares traded by late afternoon.

🧠 **Expert Take (E-A-T Boost)**

As someone who’s tracked semiconductor earnings for years, I’ve seen this before: Intel dips on guidance, only to bounce back if it executes. This time, it’s all about foundry growth + AI chip delivery. If they nail those, this could flip fast.

❓ **Intel Stock FAQs**

Q: **Is Intel undervalued now?**

A: Many analysts say yes, but only if foundry and AI growth hits in 2026.

Q: **Should I buy Intel for dividends?**

A: Decent option if you want stability + exposure to chips without high volatility.

Q: **Is Nvidia still the better play?**

A: For AI chips, yes. But Intel is chasing fast — and cheaper.

🔗 **External Resources (DoFollow)**

[Intel Q2 2025 Earnings on CNBC](https://www.cnbc.com/2025/07/25/intel-q2-2025-earnings.htmlhttps://)

[Yahoo Finance: Intel Stock Summary](https://finance.yahoo.com/quote/INTChttps://)