Bitcoin Coinbase: When the cryptocurrency market takes a sudden dip, most investors feel anxious and uncertain about the road ahead. But for others, especially seasoned and institutional players, every dip looks like an opportunity. That’s exactly what seems to be happening in the Bitcoin market right now, as new data suggests that American investors are stepping in to accumulate Bitcoin at discounted prices.

What the Coinbase Premium Gap Reveals

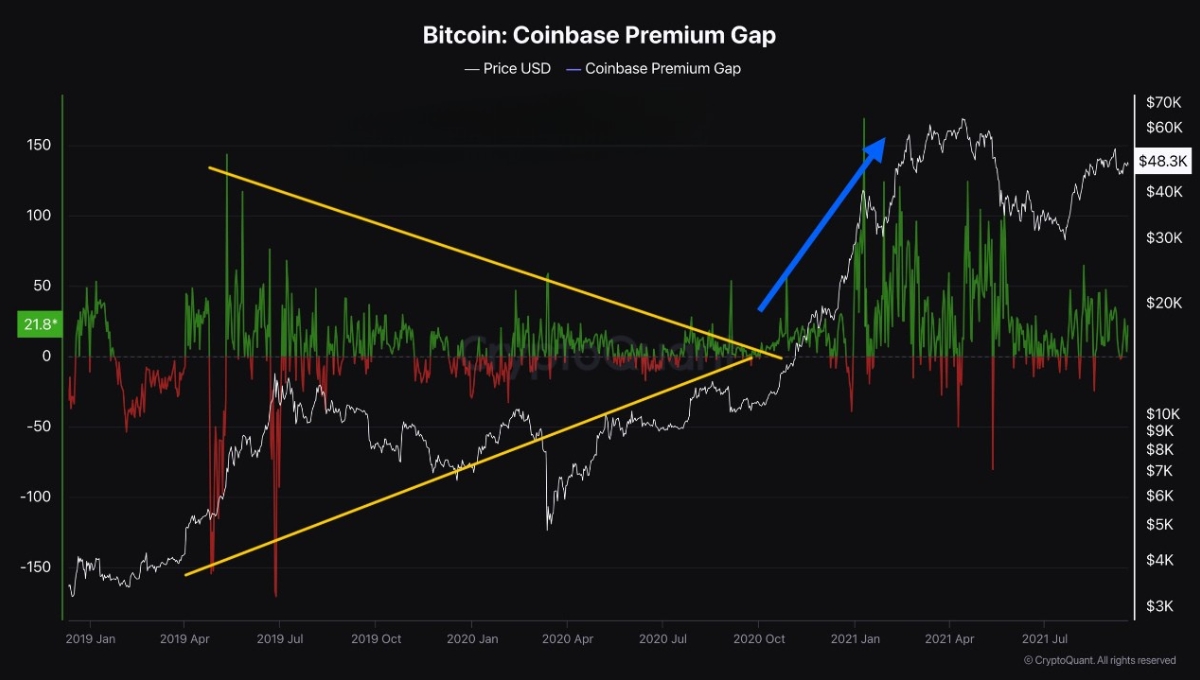

A recent analysis by CryptoQuant community analyst Maartunn has shed light on the Bitcoin Coinbase Premium Gap, an indicator that reflects the price difference of Bitcoin on Coinbase (USD pair) compared to Binance (USDT pair). Coinbase is largely dominated by American investors, including big institutional players, while Binance caters to a more global user base.

When the premium gap turns positive, it means that Bitcoin is trading higher on Coinbase than on Binance, suggesting stronger buying pressure from U.S. investors. Recently, this gap spiked sharply into positive territory, indicating that American buyers were willing to pay more for Bitcoin compared to their global counterparts.

Interestingly, this buying pressure came right after Bitcoin dipped from a recent surge to a new all-time high. Despite the correction, institutional interest in the U.S. market hasn’t faded in fact, it seems to have grown stronger.

Buying the Dip Institutional Confidence at Play

Historically, large U.S.-based investors have had a significant influence on Bitcoin’s direction. Since the beginning of 2024, they have often led market momentum by building strong positions during corrections. The current uptick in the Coinbase Premium Gap is being seen as another signal that these players are treating the dip not as a setback but as an opportunity to accumulate more BTC.

This trend highlights the difference in behavior between casual traders, who often panic during downturns, and institutional investors, who tend to view volatility as part of the long-term growth journey. Such buying activity has previously triggered strong recoveries, raising curiosity about whether this time will play out the same way.

USDC Exchange Inflows Add to the Bullish Signs

Another metric that supports the narrative of dip-buying is the movement of USDC (a stablecoin pegged to the U.S. dollar) into exchanges. The “Exchange Inflow” indicator tracks how much of an asset is sent into centralized exchange wallets. Normally, when assets like Bitcoin flow into exchanges, it often signals selling intentions. However, with stablecoins like USDC, the story is different.

When investors send billions of dollars’ worth of USDC to exchanges, it usually signals they are preparing to buy volatile assets like Bitcoin. Since the latest BTC price drop, inflows of USDC have amounted to an astonishing $3.88 billion. This indicates that investors are ready with liquidity, positioning themselves to scoop up Bitcoin at what they believe are bargain prices.

The Current State of Bitcoin

At the time of writing, Bitcoin is trading around $117,800, reflecting a minor decline of about 1% in the past 24 hours. While short-term volatility continues to dominate the charts, the underlying data shows growing confidence among American investors. With both the Coinbase Premium Gap spiking and USDC inflows rising, the market seems to be quietly building up for another potential rally.

Whether this accumulation will result in another breakout depends on how long institutional investors continue to treat corrections as opportunities rather than threats. But one thing is certain: the appetite for Bitcoin among U.S. entities remains strong, and that alone keeps the possibility of a rebound alive.

Disclaimer: This article is for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments are highly volatile and involve significant risk. Always conduct your own research or consult a financial advisor before making investment decisions.