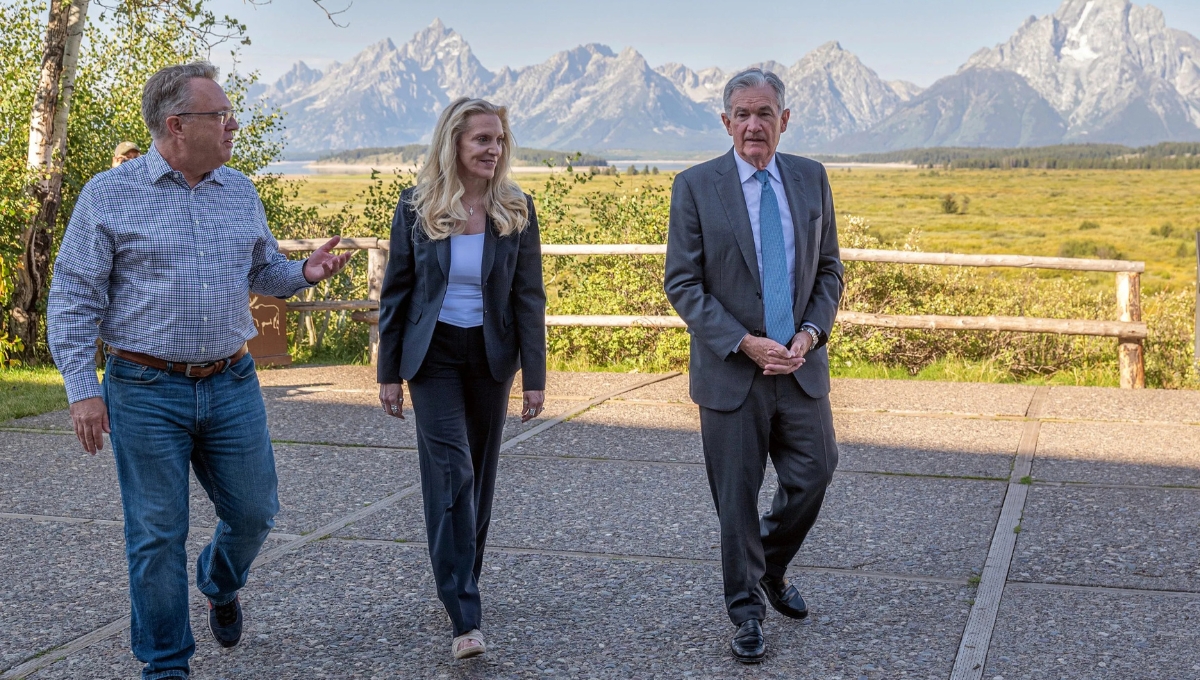

Jerome Powell’s: For weeks, investors had been holding their breath, waiting for Federal Reserve Chairman Jerome Powell to take the stage at the Jackson Hole summit. There was nervousness in the air, uncertainty in the markets, and speculation running wild. But once Powell delivered his carefully chosen words, one thing became immediately clear: traders liked what they heard.

A Cautious but Meaningful Signal

The Fed chairman pointed to encouraging economic indicators as reasons behind this potential pivot. Unemployment has remained steady, and recent data shows signs of resilience in the U.S. economy. This combination, Powell suggested, could allow borrowing costs to be eased in the coming months.

Still, his tone was measured. He acknowledged that inflation remains a thorn in the side of policymakers complicated further by tariffs introduced under former President Donald Trump. Powell stressed that any moves would be made carefully, leaving room for the Fed to change course if conditions worsen.

Reading between the lines, however, analysts believe the central bank is now preparing to cut rates by 25 basis points during its next meeting marking the first such reduction in 2025.

Trump’s Shadow and Powell’s Final Speech

This Jackson Hole appearance also carried a symbolic weight. It marked Powell’s final speech as chairman, and he made it clear his outlook shift had nothing to do with Trump, who had long pushed for lower rates and even demanded Powell’s resignation.

True to form, the former president’s response was sharp. Trump dismissed the Fed chair with his trademark bluntness, remarking, “We call him ‘Too Late’ for a reason.” But politics aside, Powell’s speech had already set off waves in both traditional and digital markets.

Crypto Markets React Instantly

The immediate aftermath of Powell’s address was perhaps most visible in the crypto space. Bitcoin surged from $112,000 to $117,000 within hours, before cooling back to $115,000. Ether, however, stole the spotlight.

After four long years, Ethereum’s native token finally brushed against record levels, soaring 15% in just under three hours. Social media platforms lit up with excitement, as traders celebrated what seemed like a long-awaited milestone.

Yet officially, Ether stopped just short of setting a new all-time high. Data from CoinMarketCap shows the November 2021 peak of $4,891.70 still holds, with Friday’s surge falling less than $8 short. Even so, it was an electrifying moment for Ethereum supporters.

And it wasn’t alone. Solana, Dogecoin, Cardano, Avalanche, Polkadot, and other major altcoins all enjoyed double-digit gains, signaling that traders’ appetite for riskier digital assets is alive and well.

Wall Street Joins the Rally

The impact didn’t stop with crypto. Wall Street roared into life after Powell’s remarks. The Dow Jones Industrial Average soared by 846 points, achieving its first record high of 2025. The S&P 500 broke a five-day losing streak, climbing 1.52% its strongest showing in months. Tech-heavy Nasdaq followed suit, jumping nearly 1.9%.

The market is now pricing in an 81% chance of a rate cut at the Fed’s September 16–17 meeting, compared with 75% before Powell spoke. If confirmed, the reduction would ease government borrowing costs, make mortgages and credit cards more affordable, and crucially push investors toward riskier assets by reducing the appeal of savings accounts.

Ethereum vs. Bitcoin A Shifting Tide

One of the more fascinating dynamics to emerge from this week’s rally is Ethereum’s rising popularity relative to Bitcoin. Data shows Bitcoin exchange-traded products saw outflows of $23 million, while Ethereum funds recorded inflows of more than $337 million.

According to analysts, Bitcoin ETFs have stabilized the coin’s price movements, making it less volatile but also less appealing for traders seeking quick returns. Ethereum, by contrast, still feels “under-owned” and more reactive to market sentiment. As one market analyst put it, “For many traders, the Bitcoin trade has already played out. Ethereum still feels exciting.”

Bitcoin supporters, however, remain unfazed. Many are doubling down on predictions that BTC is on track to hit $1 million within a few years. They argue that the current valuation fails to account for the mounting supply squeeze, with institutional investors acquiring coins faster than they can be mined. For them, the story of Bitcoin is far from over.

What Comes Next

As September’s Federal Open Market Committee meeting approaches, investors across every sector are preparing for what could be a pivotal moment. An interest rate cut would ripple far beyond Wall Street, shaping everything from global currencies to everyday household expenses.

For now, Powell’s words have provided a much-needed boost of optimism at a time when uncertainty had weighed heavily on markets. Whether crypto, stocks, or bonds every corner of the financial world seems to be bracing for a new chapter.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Cryptocurrency and stock investments carry risks, and readers are encouraged to conduct their own research or consult a financial advisor before making investment decisions.

Also Read

Bitcoin: ETFs See Longest Outflow Streak Amid Market Movements

Bitcoin’s Treasury Power Why BTC Still Rules Over Ethereum in Corporate Adoption

Crypto Market Faces Fresh Jitters After Fed Comments Bitcoin Slips Below $113,000