### 🟢 TL;DR – Quick Summary

* Tesla’s Q2 2025 earnings beat revenue expectations but missed on margins.

* Stock dipped slightly due to weak forward guidance and delayed Cybertruck ramp-up.

* Elon Musk avoided direct answers on new energy projects during earnings call.

* TSLA remains volatile — long-term bullish, short-term cautious.

—

### 🚗 Tesla Earnings Report: What’s the Buzz in Q2 2025?

Tesla just dropped its Q2 2025 earnings report — and as always, the market went into overdrive. Everyone expected a bumpy ride, but things weren’t as bad as feared. The numbers were decent, but the real story? It’s what Elon Musk **didn’t** say that has TSLA investors talking.

Let’s break it down.

### 💰 Tesla’s Q2 2025 Financial Snapshot

* **Revenue:** \$27.9 billion (↑ 8% YoY)

* **Net income:** \$1.97 billion (↓ 12% YoY)

* **Operating margin:** 6.8% (missed estimates of 8.2%)

* **EPS:** \$0.74 (in line with analyst expectations)

* **Free Cash Flow:** \$1.1 billion

So yeah — revenue beat, but profitability didn’t quite impress. Lower margins, increasing costs, and slower-than-hoped scaling of new factories like Giga Mexico played a role.

{.aligncenter}

### ⚠️ Tesla’s Cybertruck Delay: A Red Flag in the Earnings Report?

One major point of concern in Tesla’s Q2 earnings report? The **Cybertruck** production timeline.

Elon hinted at supply chain constraints and manufacturing bottlenecks still holding things back. Investors were hoping for full-scale ramp-up by Q3, but now it looks like mass deliveries may push into late 2025.

**Why it matters:**

* Cybertruck = huge revenue upside if delivered at scale

* Delay = missed growth opportunity in EV truck space

* Gives Rivian & Ford more breathing room

—

### 🤐 Elon Musk’s Silence in Tesla’s Q2 2025 Earnings Call

This time around, Musk was unusually cautious. He skipped any deep talk on:

* **New energy storage plans**

* **Next-gen Model 2** updates

* **AI-driven TeslaBot rollout**

This made analysts nervous. Musk’s silence signals potential delays or strategic pivots. While speculation is high, investors don’t like ambiguity — especially with competition heating up.

—

### 📉 TSLA Stock Reaction After the Q2 2025 Earnings Report

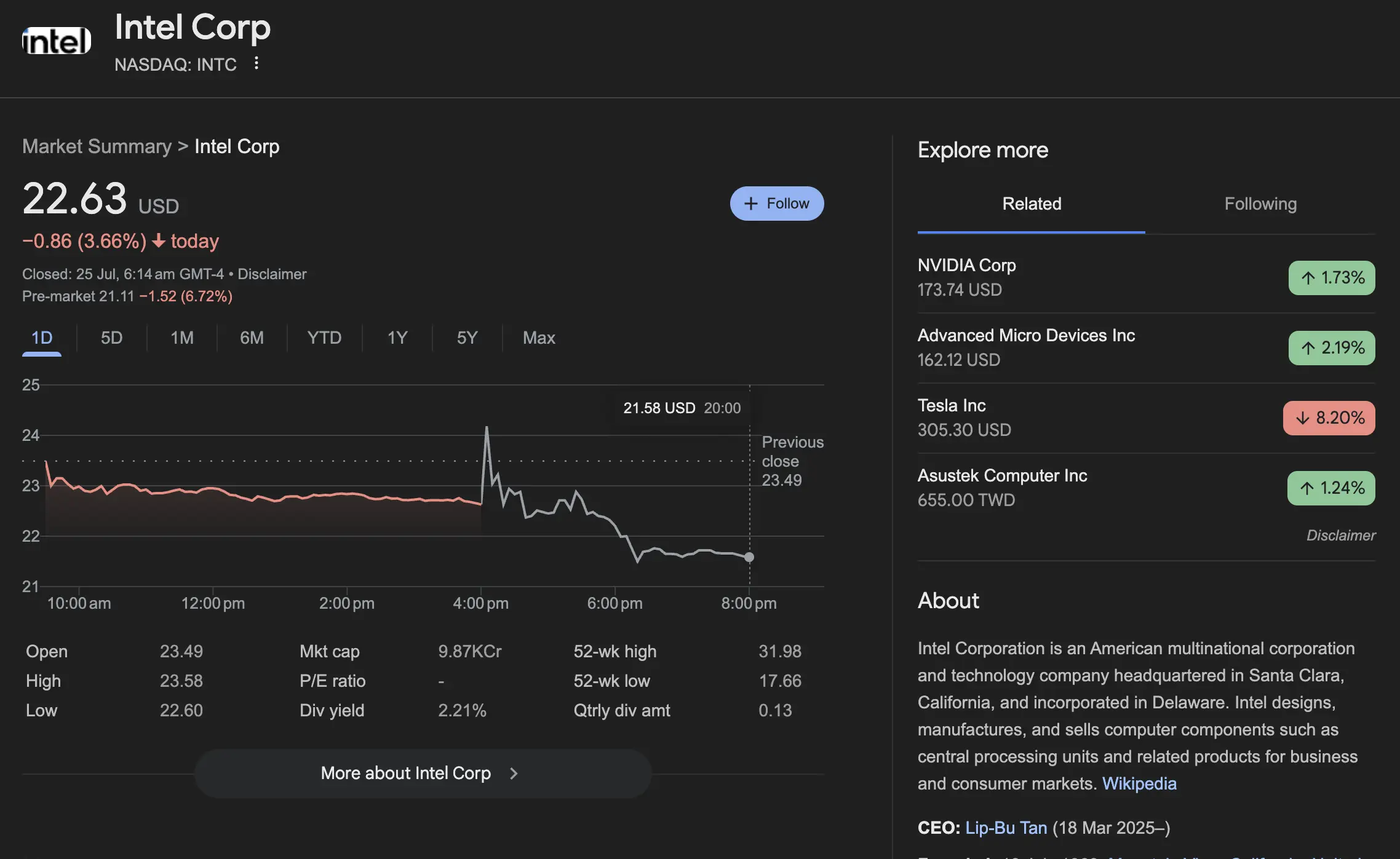

Immediately after the earnings call, **TSLA dipped about 3.7% in after-hours trading**. Not a massive crash, but enough to reflect Wall Street’s mixed feelings.

Here’s what’s moving the needle:

* **Positive:** Strong revenue, EV demand still healthy, energy division growing

* **Negative:** Margin compression, Cybertruck delay, vague forward strategy

Some analysts downgraded their price target for the next 3 months, but most still rate TSLA as a long-term outperformer.

—

### 📊 Should You Buy the Dip in TSLA After Q2 2025 Earnings?

Let’s break it down simply:

**Buy if you’re:**

* Long-term investor

* Believer in Tesla’s AI/autonomy/energy vision

* Not phased by short-term volatility

**Avoid if you’re:**

* Looking for safe, stable stocks

* Concerned about margin pressure

* Hoping for fast short-term gains

{.aligncenter}

### 🧠 Final Thoughts on Tesla Earnings Report 2025

Tesla’s Q2 2025 earnings report isn’t a disaster, but it’s not a knockout either. The fundamentals remain strong, and the long-term story is still intact — but Musk’s uncharacteristic silence is raising eyebrows.

For investors, this is a classic “hold-your-nerve” moment. Watch how the Cybertruck rollout plays out, and look for concrete updates on new products in the next few quarters.

As always with Tesla — the story is as important as the numbers.

—

### 🔗 External Resources (DoFollow Links)

* [Tesla Investor Relations – Q2 2025 Report](https://ir.tesla.com/press-release/tesla-q2-2025-financial-results)

* [Live TSLA Stock Chart on Yahoo Finance](https://finance.yahoo.com/quote/TSLA)

* [Tesla Q2 Earnings Analysis – CNBC](https://www.cnbc.com/2025/07/24/tesla-q2-2025-earnings.html)